Chesapeake, Virginia-based Dollar Tree, Inc. (DLTR) operates retail discount stores under the Dollar Tree and Dollar Tree Canada brands. With a market cap of $26.4 billion, the company sells an assortment of everyday general merchandise, as well as offers kitchen and dining, toys, books, crafts, cleaning, personal care, glasses, food carriers, gifts, and other household products. The discount retail giant is expected to announce its fiscal fourth-quarter earnings for 2025 in the near term.

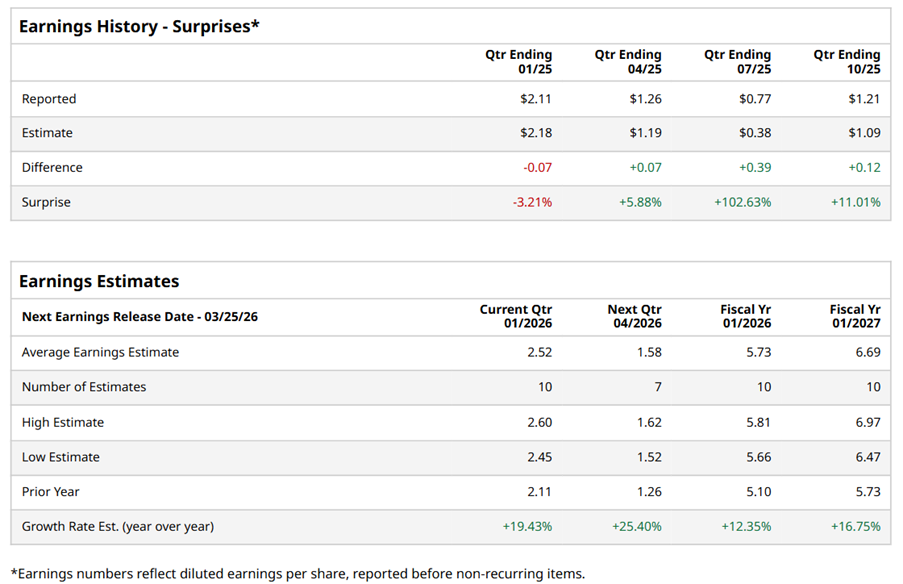

Ahead of the event, analysts expect DLTR to report a profit of $2.52 per share on a diluted basis, up 19.4% from $2.11 per share in the year-ago quarter. The company beat the consensus estimates in three of the last four quarters while missing the forecast on another occasion.

For the full year, analysts expect DLTR to report EPS of $5.73, up 12.4% from $5.10 in fiscal 2025. Its EPS is expected to rise 16.8% year over year to $6.69 in fiscal 2027.

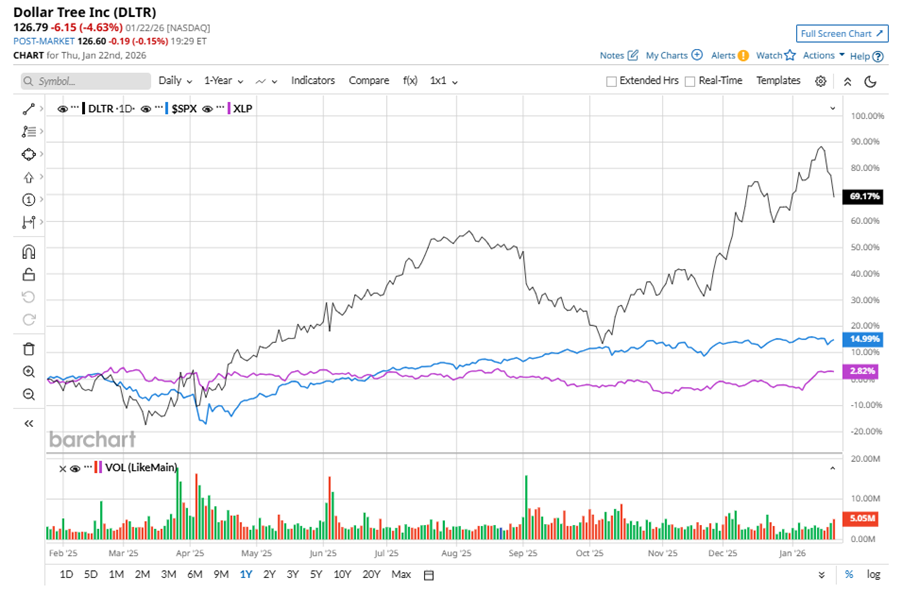

DLTR stock has considerably outperformed the S&P 500 Index’s ($SPX) 13.6% gains over the past 52 weeks, with shares up 76.2% during this period. Similarly, it significantly outperformed the Consumer Staples Select Sector SPDR Fund’s (XLP) 6.5% returns over the same time frame.

DLTR’s strong performance is driven by its multi-price strategy, expanded discretionary assortment, and operational efficiency. The company's Halloween sales were strong, and its multi-price offering is boosting profitability, with each item sold delivering 3.5x more profit than fixed-price items. Dollar Tree's customer base is broadening, with higher-income households shopping more, and the company is focusing on increasing trip frequency among these new shoppers. With improved supply chain performance and cost management, DLTR expects continued seasonal strength and margin expansion.

On Dec. 3, 2025, DLTR shares closed up by 3.6% after reporting its Q3 results. Its revenue was $4.8 billion, exceeding analyst estimates of $4.7 billion. The company’s adjusted EPS of $1.21 beat analyst estimates by 11.8%.

Analysts’ consensus opinion on DLTR stock is moderately bullish, with a “Moderate Buy” rating overall. Out of 27 analysts covering the stock, nine advise a “Strong Buy” rating, 14 give a “Hold,” two recommend a “Moderate Sell,” and two advocate a “Strong Sell.” While DLTR currently trades above its mean price target of $118.74, the Street-high price target of $160 suggests an upside potential of 26.2%.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart