Cummins (CMI)

571.79

-11.28 (-1.93%)

NYSE · Last Trade: Jan 23rd, 4:11 PM EST

As we look back from the vantage point of January 2026, the financial landscape of 2024 stands as a watershed moment in economic history. It was the year that corporate America finally broke the traditional bond between profit growth and payroll expansion, ushering in what economists now call the "Jobless

Via MarketMinute · January 23, 2026

As the first month of 2026 draws to a close, the dust is only beginning to settle on one of the most volatile periods in recent corporate history. Throughout 2025, a cloud of "unquantifiable uncertainty" hung over the balance sheets of the world’s largest companies. As of January 23,

Via MarketMinute · January 23, 2026

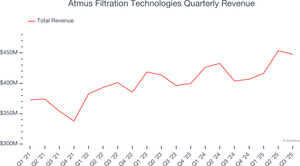

As the Q3 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the gas and liquid handling industry, including Atmus Filtration Technologies (NYSE:ATMU) and its peers.

Via StockStory · January 22, 2026

Applied Digital APLD Q2 2025 Earnings Transcript

Via The Motley Fool · January 22, 2026

Applied Digital APLD Q4 2024 Earnings Transcript

Via The Motley Fool · January 22, 2026

Applied Digital APLD Q1 2025 Earnings Transcript

Via The Motley Fool · January 22, 2026

As of January 19, 2026, Caterpillar Inc. (NYSE: CAT) stands as the undisputed titan of the Dow Jones Industrial Average, capping off a historic 12-month run that saw its share price surge nearly 62%. Once viewed primarily as a barometer for global construction and mining, the company has successfully rebranded

Via MarketMinute · January 19, 2026

Movers and shakers in today's after-hours session for S&P500 stocks?chartmill.com

Via Chartmill · January 19, 2026

While profitability is essential, it doesn’t guarantee long-term success.

Some companies that rest on their margins will lose ground as competition intensifies - as Jeff Bezos said, "Your margin is my opportunity".

Via StockStory · January 18, 2026

Wrapping up Q3 earnings, we look at the numbers and key takeaways for the gas and liquid handling stocks, including Graco (NYSE:GGG) and its peers.

Via StockStory · January 18, 2026

Applied Digital Q2 2026 Earnings Call Transcript

Via The Motley Fool · January 15, 2026

Filtration products manufacturer Atmus Filtration Technologies (NYSE:ATMU) announced better-than-expected revenue in Q3 CY2025, with sales up 10.9% year on year to $447.7 million. Its non-GAAP profit of $0.69 per share was 15.1% above analysts’ consensus estimates.

Via StockStory · January 15, 2026

Applied Digital's fourth quarter was marked by strong revenue growth and a positive market reaction, with results exceeding Wall Street expectations. Management credited the rapid energization of the Polaris Forge 1 data center, which began generating lease revenues ahead of schedule, as a key driver. CEO Wes Cummins highlighted the completion of the first of three contracted buildings for CoreWeave and the signing of a major lease with a U.S.-based hyperscaler as instrumental milestones. The company also benefited from robust demand for high-performance computing infrastructure, particularly for artificial intelligence and cloud workloads. Management emphasized that modular, efficient construction and access to low-cost energy in the Dakotas provided a competitive advantage.

Via StockStory · January 14, 2026

The past six months have been a windfall for Cummins’s shareholders. The company’s stock price has jumped 66.8%, setting a new 52-week high of $567.59 per share. This was partly thanks to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Via StockStory · January 13, 2026

Applied Digital is soaring impressively in 2026 already, but can it deliver more gains?

Via The Motley Fool · January 13, 2026

Caterpillar Inc. (NYSE: CAT) has long been the primary barometer for the global construction and mining industries, but in early 2026, the industrial giant has found a new, high-voltage catalyst: the artificial intelligence revolution. As of January 13, 2026, Caterpillar’s stock has surged into a fresh technical "buy zone"

Via MarketMinute · January 13, 2026

As of January 13, 2026, the global obsession with artificial intelligence has transitioned from a race for digital supremacy into a grueling battle for physical resources. While the initial years of the AI boom were defined by a desperate scramble for high-end semiconductors, the narrative has shifted fundamentally. Today, the

Via MarketMinute · January 13, 2026

On January 12, 2026, Caterpillar Inc. (NYSE: CAT) solidified its position as the undisputed titan of the industrial sector, with its stock price surging to a fresh all-time record of $627.75. The rally was ignited by a bullish research note from Citigroup, which raised its price target for the

Via MarketMinute · January 12, 2026

As the Q3 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the heavy transportation equipment industry, including Cummins (NYSE:CMI) and its peers.

Via StockStory · January 11, 2026

Steam turbines will start powering AI workloads in 2028.

Via The Motley Fool · January 11, 2026

In a landmark decision that bridges the gap between massive AI compute demands and sustainable energy solutions, Bloom Energy (NYSE: BE) shares skyrocketed by more than 18% in early trading on January 8, 2026. The surge follows the final regulatory approval for a colossal 1.8-gigawatt (GW) AI data center

Via MarketMinute · January 8, 2026

As of January 8, 2026, the landscape of high-performance computing (HPC) has undergone a tectonic shift, and few companies embody this transformation more than Applied Digital (Nasdaq: APLD). Once a niche player in the cryptocurrency hosting space, Applied Digital has successfully repositioned itself as a critical backbone for the generative AI revolution. The company is [...]

Via PredictStreet · January 8, 2026

Digital infrastructure provider Applied Digital (NASDAQ:APLD) announced better-than-expected revenue in Q4 CY2025, with sales up 98.2% year on year to $126.6 million. Its non-GAAP loss of $0 per share was significantly above analysts’ consensus estimates.

Via StockStory · January 8, 2026

Applied Digital’s HPC hosting business contributed $85 million. Its data center hosting contributed $41.6 million, up 15% year-over-year.

Via Stocktwits · January 7, 2026

Digital infrastructure provider Applied Digital (NASDAQ:APLD) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 98% year on year to $126.6 million. Its non-GAAP loss of $0 per share was significantly above analysts’ consensus estimates.

Via StockStory · January 7, 2026